Are you tired of watching your salary vanish before the month ends? Does it feel like your money is slipping away without you even knowing where it’s going? Or perhaps you’re ready to start saving but have no idea where to begin? If any of these sound familiar, you’re not alone. Managing money effectively has become a significant challenge for many people, especially with the rising cost of living and unexpected expenses.

Fortunately, there’s a simple yet powerful method that can transform the way you handle your finances: the 50/30/20 rule. Unlike complicated budgeting systems or financial planning tools, the 50/30/20 rule provides a clear, straightforward structure for managing your money. It doesn’t require advanced calculations or financial expertise. All it takes is a simple division of your income into three specific categories, each serving a distinct purpose that brings order to your financial life.

In this comprehensive guide, we’ll break down the 50/30/20 rule, explain how it works, and provide practical examples to help you create a realistic monthly budget that aligns with your financial goals. Let’s get started.

What Is the 50/30/20 Rule?

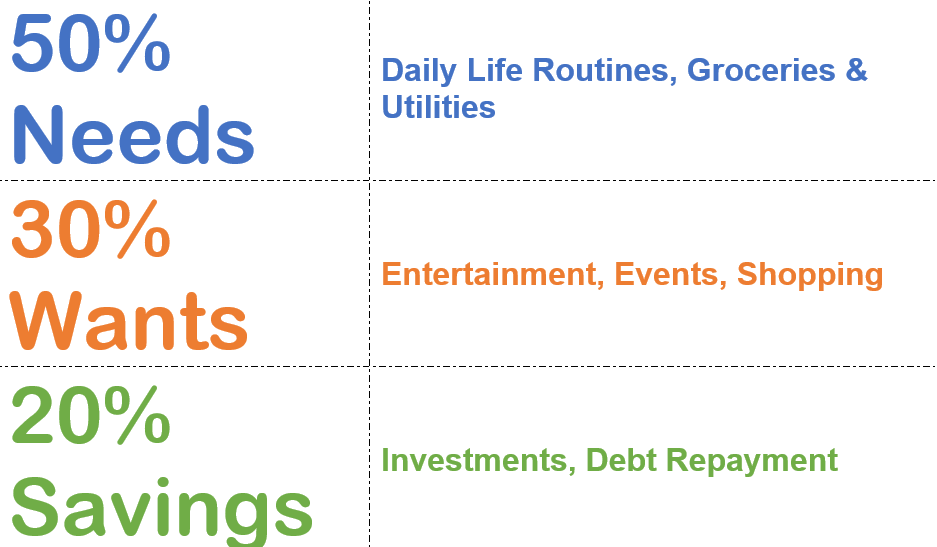

The 50/30/20 rule is a widely recommended budgeting method that divides your monthly income into three main categories:

- Needs (50%): This category includes all essential expenses that you can’t live without. Think of it as the must-haves—those necessary costs that keep your life running smoothly. Examples include rent or mortgage payments, utility bills, groceries, transportation, and essential healthcare expenses.

- Wants (30%): This is your spending allowance for non-essential items—the things you enjoy but could technically live without. This category covers dining out, entertainment, hobbies, shopping, and other discretionary spending.

- Savings & Debt Repayment (20%): The remaining portion of your income goes toward building financial security. This includes saving for emergencies, investing in long-term goals, and paying down existing debts.

The 50/30/20 rule was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan.” Its simplicity and practicality have made it a go-to method for those looking to gain control over their finances without getting bogged down by complex budgeting systems.

Now, let’s explore how you can effectively implement this budgeting rule to make your money work for you.

1. Allocate 50% of Your Income to Essential Needs

The first step in applying the 50/30/20 rule is to determine your essential expenses. Ideally, half of your net income should be dedicated to covering basic living costs. This includes:

- Rent or mortgage payments

- Utility bills (electricity, water, gas, internet, mobile)

- Groceries and necessary household items

- Transportation (fuel, public transit, car maintenance)

- Insurance premiums

- Childcare or school fees

For instance, if your monthly income after taxes is $4,000, your budget for essential needs would be $2,000. But what if your essentials exceed this limit? It’s not uncommon for housing or childcare costs to consume a large portion of your income, especially in high-cost living areas. In such cases, consider reducing expenses in the “Wants” category or exploring cost-saving strategies, such as meal planning or negotiating lower bills.

Keep in mind that the goal is to keep essentials within 50% of your income, but life isn’t always that simple. The 50/30/20 rule serves as a guideline, not a strict mandate. Flexibility is key.

2. Reserve 30% of Your Income for Wants

After covering your essential needs, the next 30% of your income is set aside for discretionary spending. This is where you get to enjoy life’s little pleasures without feeling guilty about spending money. Think of it as your “fun money” budget. Examples of spending in this category include:

- Dining out or ordering takeout

- Entertainment (movies, concerts, events)

- Shopping for clothes or gadgets

- Subscriptions (Netflix, gym memberships, streaming services)

- Travel and vacations

Using our previous example of a $4,000 monthly income, you would allocate $1,200 for wants. However, this doesn’t mean you should splurge without thinking. If you’re carrying high-interest debt or saving for a major goal, you might consider redirecting some of this money toward those priorities.

A helpful tip when deciding what qualifies as a “want” versus a “need” is to ask yourself: Is this something I could live without? If the answer is yes, it’s likely a want.

3. Dedicate 20% of Your Income to Savings and Debt Repayment

The final 20% of your income is reserved for future financial security. This includes building an emergency fund, investing for long-term goals, and paying down debt. Some examples of how you might use this money include:

- Setting up a rainy-day fund with 3-6 months’ worth of expenses

- Contributing to retirement accounts or investment portfolios

- Paying off credit card balances or student loans

- Saving for a down payment on a home

For instance, with a $4,000 income, the 20% allocation would amount to $800 per month. If you’re carrying high-interest debt, consider prioritizing debt repayment to minimize interest charges. Once you’re debt-free, you can redirect these funds toward savings and investments.

Is the 50/30/20 Rule Suitable for You?

While the 50/30/20 rule is a great starting point, it’s not a one-size-fits-all approach. Factors such as income level, family size, cost of living, and financial goals will influence how closely you can adhere to these percentages. The key is to use this rule as a guideline, making adjustments based on your unique circumstances.

For example, someone living in a high-cost city may need to allocate more than 50% to essentials, while someone in a lower-cost area may have more flexibility in the “Wants” category.

Conclusion

The 50/30/20 rule is more than just a budgeting method—it’s a mindset shift that promotes financial balance and security. By dividing your income into needs, wants, and savings, you can gain control over your finances without feeling overwhelmed. Start by assessing your current spending habits, make necessary adjustments, and set realistic goals. Remember, even small changes can lead to significant financial progress over time.